News & Politics

Sub Category

On Monday, the stock market showcased a notable uptick, with traders eagerly anticipating a wave of corporate earnings reports. Despite the rising Treasury yields, the market's momentum remained undeterred. The Dow Jones Industrial Average surged by 328 points, marking a 1% increase. Similarly, both the S&P 500 and the Nasdaq Composite experienced a 1.1% climb.

Leading the charge for the Dow were giants like Nike and Intel, both registering around a 2% growth. The S&P 500 sectors also followed suit, with all 11 sectors trading in the green. As we delve deeper into the week, we're set to witness earnings reports from industry stalwarts such as Johnson & Johnson, Bank of America, Netflix, and Tesla.

The onset of the reporting period has been promising. Charles Schwab, for instance, saw a commendable 5% rally on Monday after exceeding Wall Street's earnings per share expectations for Q3. Other major players like JPMorgan Chase, Wells Fargo, and UnitedHealth also reported positive quarterly results.

However, the road ahead might not be entirely smooth. With rising yields, fluctuating oil prices, persistent inflation, and geopolitical tensions in the Middle East, Wall Street is gearing up for potential volatility. Yet, Barclays analyst Ajay Rajadhyaksha remains hopeful, emphasizing the role of earnings and the Federal Reserve's decisions on interest rates in bolstering investor confidence.

Recent global events have also played a part in shaping market dynamics. Israel's military actions in northern Gaza and the U.S.'s commitment to support Israel have been significant developments. The 10-year U.S. Treasury yield witnessed a jump, and oil prices underwent adjustments in light of the ongoing conflict.

Reflecting on the past week, the S&P 500 and the Dow Jones Industrial Average recorded gains, while the Nasdaq Composite experienced a slight dip. Aoifinn Devitt, CIO of Moneta Group, highlighted the market's resilience and adaptability in the face of geopolitical surprises.

UBS's Mark Haefele provided insights into the potential trajectory of the 10-year Treasury, suggesting a possible decline below 4% by mid-2024. He also projected the S&P 500 to reach the 4,500 mark. Haefele's analysis is rooted in the belief that bond vigilantes remain unfazed by the possibility of a U.S. default.

In other news, UBS upgraded UnitedHealth post their Q3 earnings success, emphasizing its potential as a core portfolio asset. The Nasdaq Composite and the Nasdaq-100 also witnessed significant gains, with tech and software stocks leading the way. Lululemon Athletica, Atlassian, Datadog, Fortinet, and Ross Stores were among the top performers.

In conclusion, the stock market's recent performance paints a picture of resilience, adaptability, and potential growth. For those keen on diving deeper into the world of investing, Dr. Boyce offers invaluable insights. To learn more about investing, visit BoyceWatkins.com.

The Black Financial Channel is a news and business channel designed specifically for the African American community. We give daily financial updates on stock markets, investing and other related topics that appear in financial news.

The Black Financial Channel is sponsored by The Black Business School. To join The Black Business School and get started for free, please visit http://TheBlackBusinessSchool.com.

You can enroll in Dr Watkins' Stock Market Investing class by visiting http://TheBlackStockMarketProgram.com.

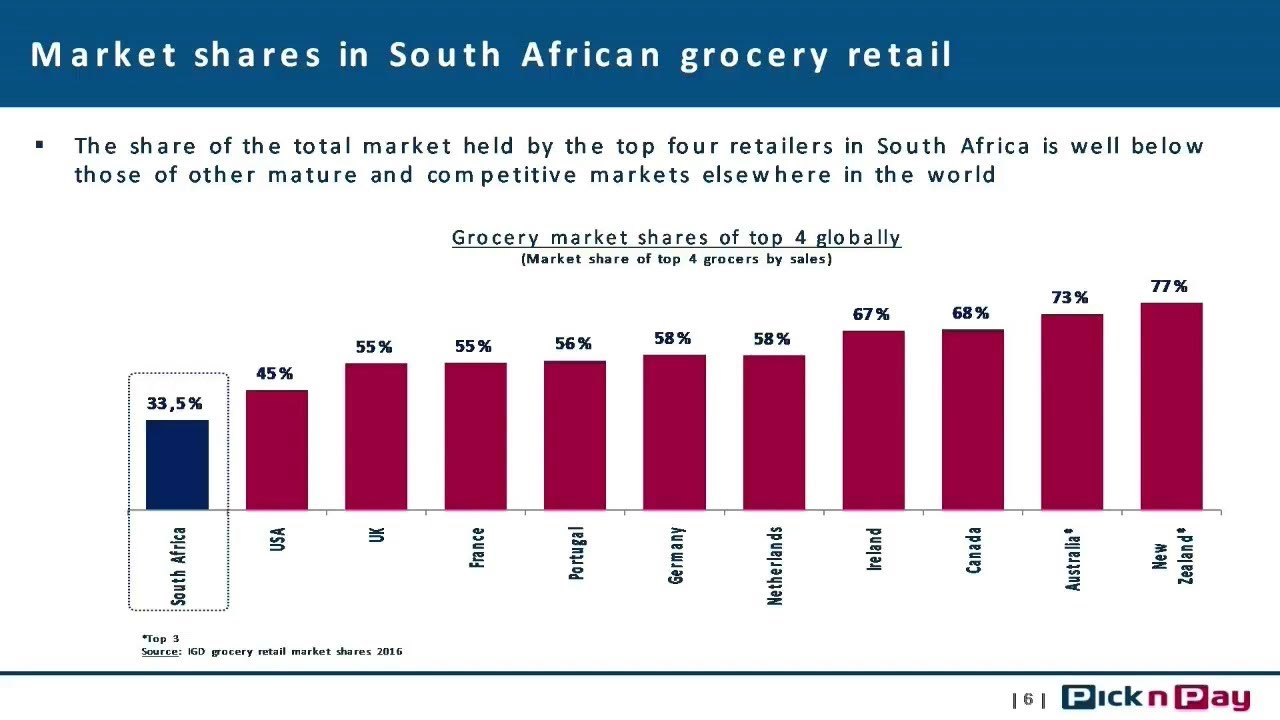

Pick n Pay presentation to the Competition Commission's Inquiry in November 2017 covers market shares in South Africa

Easy Equities South Africa - Investing in New York Stock Exchange Companies #southafrica #investment

Decided to make this video.

This Video is for stock traders, to show and educate one of the safest ways to trade stock safely.

NB

On Next Monday @12pm I will be doing another on Stock Trading. I invite you to learn.

Note

Share your thoughts by commenting below.

--------

Our aim is to release content that will educate and help you on your journey.

We promise growth when you watch our videos, if you are not happy, then talk to us by commenting, however, if you are happy, please share our videos.

Subscribe to our YouTube Channel:

William S - Rewake Video

If you have big goals for Africa, here's where you can start.

𝟎. 𝐂𝐎𝐍𝐆𝐑𝐀𝐓𝐔𝐋𝐀𝐓𝐄 𝐘𝐎𝐔𝐑𝐒𝐄𝐋𝐅 !

You will be doing something good for mother-nature by just wanting to impact the continent!

𝟏. 𝐏𝐥𝐚𝐧 𝐟𝐨𝐫 𝐭𝐡𝐞 𝐧𝐞𝐱𝐭 𝟐-𝟑 𝐝𝐞𝐜𝐚𝐝𝐞𝐬 𝐧𝐨𝐰.

Wealth-creation in the continent is a long-term process, but you should start asap to be ready over the next decade.

2. 𝐇𝐚𝐯𝐞 𝐚 𝐠𝐞𝐧𝐞𝐫𝐚𝐭𝐢𝐨𝐧𝐚𝐥-𝐰𝐞𝐚𝐥𝐭𝐡 𝐩𝐥𝐚𝐧.

Ask yourself how your idea will not only make you rich, but would also bring real wealth to Africans. We are more and more educated and no longer just want to be consumers.

3. 𝐒𝐭𝐚𝐫𝐭 𝐭𝐨𝐝𝐚𝐲 𝐰𝐢𝐭𝐡 𝐭𝐡𝐞 𝐡𝐢𝐠𝐡𝐞𝐬𝐭 𝐨𝐟𝐟𝐞𝐫 𝐟𝐫𝐨𝐦 𝐲𝐨𝐮𝐫 𝐢𝐝𝐞𝐚.

Hire help ASAP if you need to learn how to position and get buy-in (real buyers) for your offer.

𝟒. 𝐒𝐭𝐚𝐫𝐭 𝐛𝐮𝐢𝐥𝐝𝐢𝐧𝐠 𝐲𝐨𝐮𝐫 𝐨𝐰𝐧 𝐦𝐨𝐯𝐞𝐦𝐞𝐧𝐭.

If you still believe there's competition, there is not. There's no traffic for those who are willing to go the extra-mile. Keep this in mind.

5. 𝐏𝐥𝐚𝐧 𝐭𝐨 𝐬𝐜𝐚𝐥𝐞 rapidly 𝐢𝐧 𝐭𝐡𝐞 𝐥𝐨𝐧𝐠-𝐭𝐞𝐫𝐦, in ones of the biggest market sectors of the continent...(see picture)

These are just some of the topics that I touch on with my clients who are excited about Africa, in my 𝑨𝒇𝒓𝒊𝒄𝒂𝒏 𝑾𝒆𝒂𝒍𝒕𝒉 & 𝑳𝒆𝒈𝒂𝒄𝒚 𝒑𝒓𝒐𝒈𝒓𝒂𝒎. Let's get in touch if you would like to learn more.

African Bank says it's looking to list on the Johannesburg Stock Exchange by 2025.

The banking group has released its annual financial results for the 12 months ending September 2022.

It recorded a nearly 40% jump in profitability as it continues to expand its transactional base.

African Bank is also hopeful about recent acquisition moves in buying up traditional mining bank, Ubank, and small business bank, Grindrod.

For more news, visit sabcnews.com and also #SABCNews on all Social Media platforms.

► Subscribe to the Financial Times on YouTube: http://bit.ly/FTimeSubs

Africa emerging as the most powerful developing market look distant while publicly-traded volumes remain thin. Clifford Mpare, Frontline Capital Advisors chief executive, tells John Authers long-term private equity investment is the safest way forward.

► FT Markets: http://bit.ly/1J5HNd3

► Authers’ Note: http://bit.ly/1Liu16x

For more video content from the Financial Times, visit http://www.FT.com/video

Twitter https://twitter.com/ftvideo

Facebook https://www.facebook.com/financialtimes

Top 10 #youtubeshorts #shortvideo#gold#ytshorts

In commemoration of the international significance of Africa Day 2021, CEO, Asher Dynamic Solutions, Muktar Mohammed, joined #NCBusinessEdge to discuss some of the major stock markets on the continent and how they have been performing.

.......................................

Don't forget to subscribe to our channel: https://bit.ly/2J1dFFf

Watch more amazing videos about #Africa: https://bit.ly/2J1

Watch News Central TV live: https://www.youtube.com/embed/....live_stream?channel=

Get social with News Central TV:

Twitter: https://twitter.com/NewsCentralTV

Instagram: https://www.instagram.com/newscentraltv/

Read more news on our website: https://www.newscentral.africa/

This is a tour of the richest part of South Africa, Sandton Central.

This is where the JSE or Johannesburg stock exchange is located.

Music provided by Basman GZ.

Instrumental: "Jubilation" by Basman GZ

Channel: https://www.youtube.com/channe....l/UCQ-9_bHmf5B3fjQRF

Subscribe to my youtube channel via this link:

https://www.youtube.com/channe....l/UClHXladdyNkndbgXY

The Globalization Wave and Stock Market Return in Africa

SMART 24 TV: STOCK MARKETS UPDATES -, AFRICAN STOCK MARKET, UNDERSTANDING THE CURRENT SITUATION OF STOCKS AND SHARES IN UGANDA.

MMSteelClub hosted the most awaited Steel, Metals and Mining Week! If you missed it, don't worry! Here are the highlights of the Middle East and North Africa Steel Session !

International Stock Loans and Stone Creek Global are pleased to lend on the JSE in South Africa.

All public corporations, company insiders and investors are welcome.

To learn more about our loans please download our FREE lending guide here:

https://internationalstockloan....s.com/stock-lending-

Contact us directly to learn more:

lino@internationalstockloans.com

skype:lino.demarchi1

WhatsApp: 1-778-938-5732

www.InternationalStockLoans.com

We extend a warm welcome to The Africa News Network.

If you like this video, please like, share, comment, subscribe and turn the notification bell. Watch out for our next video.

Looking to grow your investments? Join us as we uncover the top African stocks to buy now and why they're worth your attention! Africa's booming economies and technological advancements have created a fertile ground for savvy investors. In this exciting video, we'll explore some top African stock market opportunities any motherland investor worth his/her salt should be considering. Big names like Safaricom, VanEck Africa Index, MTN etc. – the leading stocks that promise significant growth and returns. Don't miss out on this chance to participate in the African success story. Watch now and make informed investment decisions to secure your financial future!

***********************************************************************************************

african stocks,south african stock exchange,shares of african companies,african stock market,how to invest in the african stock market,south african stock market,richest companies in africa,stock market in african,how to invest in easyequities south africa,invest in realestate africa,own shares in top african companies,best african stocks to invest in 2024,motherland investors,wode maya,african diaspora invest,what is the best african stocks to buy

Special Program:

East African financial integration and Ethiopia's stock market.

South African stock market update

Drivers of Stock Market Returns in Sub-Saharan Africa Evidence from Selected Countries

JSE Artificial Intelligence Trading Review Of The South African Stock Market JSE 23rd July 2021.

Screening about 140 stocks in the JSE South African market using AI to find high probability trade ideas based on 4 AI trading strategies.

Happy AI trading.

Regards

Richard